franchise tax board fresh start program

Please have your 11-digit taxpayer number ready. Dont Let the IRS Intimidate You.

How To Pay Ca Franchise Tax Board Taxes Landmark Tax Group

We are unique in that we can provide Tax Court Services Representation in any jurisdiction in the United States.

. The Fresh Start program increased the amount that taxpayers can owe before the IRS generally will. The Fresh Start Program is a collection of changes to the tax code. Ad BBB A Top Rated Tax Defense Company.

The Fresh Start initiative offers taxpayers the following ways to pay their tax debt. California Tax Service Center. Michael Romero 2.

A tax lien represents the governments legal claim over the assets of a noncompliant taxpayer. Free Case Review Begin Online. Based On Circumstances You May Already Qualify For Tax Relief.

That means you can avoid a tax lien if you owe the IRS 9999 or less. The Fresh Start Initiative may be the option for you. Ad Determine if you qualify for the Fresh Start Program.

Ad Dont Face the IRS Alone. Get A Free Consultation For IRS Fresh Start Program. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes.

If you owe the FTB 25000 or less you can do it yourself by either calling a toll-free. The Fresh Start Program has increased the IRS Notice of Federal Tax Lien filing threshold from a minimum liability of 5000 to 10000. In many situations the FTB operates.

We May Lower Your FTB Balance and Get You A Better Outcome. Corporations must pay a minimum. Individuals who have tax debt with more than 1 agency - Multi-Agency Form for Offer in Compromise DE 999CA 6.

Corporate Franchise Tax Corporations must report income as follows. Now to help a greater number of taxpayers the IRS has expanded the program by adopting more flexible Offer-in-Compromise terms. It is important to note that.

IRS Offer-in-Compromise and the Fresh Start Program. Net income of corporations in the District on a combined reporting basis. End Your Tax NightApre Now.

SAN DIEGO FRESH START PROGRAM LLC. Under the Fresh Start initiative the IRS can file a lien notice only if you owe 10000 or more in back taxes. Call for a Free Tax Consultation today to explore all.

Some of the most common limitations on the Fresh Start Initiative are. End Your Tax NightApre Now. We provide Superior Tax.

Fresh Start in 2011 to help struggling taxpayers. The Franchise Tax Board FTB is the California tax agency that collects and enforces state income tax assessment and collection. Ad See If You Qualify For IRS Fresh Start Program.

Ad Determine if you qualify for the Fresh Start Program. The Mayor and Council also should start working now with Congress to eliminate numerous federal rules that make DCs reserve far more restrictive than the rainy day funds in. Sponsored by Californias tax agencies Board of Equalization Employment Development Department and Franchise Tax Board and the IRS for.

Join Today and Benefit Daily from ABIs 35 Years of Insolvency Expertise. While we are available Monday through Friday 8 am-5 pm. Self-employed individuals must provide proof of a 25 drop in their net income.

The California Franchise Tax Board FTB established a similar Fresh Start program in March 2012. Get Free Competing Quotes For IRS Fresh Start Program. Americans with back taxes may qualify for tax relief in as little.

The CFY must start after completion of the academic and clinical practicum requirements. You May Qualify to be Forgiven for Thousands of Dollars in Back Taxes. The Fresh Start Initiative may be the option for you.

The government may resort to placing tax liens in an attempt to. 1061 Entry of the regulated professional into a treatment program approved. Tax Liens and Fresh Start.

It offers varying levels of relief and repayment options based on the specific financial situation of each applicant. Joint filers cannot earn more than. Ad 5 Best Tax Relief Companies of 2022.

Serving all of California for the last 36 years. Ad 5 Best Tax Relief Companies of 2022. Businesses - Offer in Compromise Booklet and Application for.

Loss of Income from 5 Years of Imprisonment 46KYear. The IRS Fresh Start Tax Settlement program has made it easier for taxpayers to qualify for an offer-in-compromise and has added. Wherever you live in California Fresno IRS Fresh Start Program can and will help with your IRS tax debt or Franchise Tax Board tax issue.

Central Time shorter wait times normally occur from 8-10 am. Company Number 201129910171 Status Franchise Tax Board Ftb SuspendedForfeited Incorporation Date 19 October 2011. The Federal Government Offers To Wipe Out Your Tax Debt Through New IRS Fresh Start Program.

Free Case Review Begin Online. But they did say that they would be filing fewer liens simplifying the procedure for removal of a lien and streamlining the Offer in Compromise program for certain taxpayers. Seizure of Your Home Equity CarsBusiness and Investments.

Based On Circumstances You May Already Qualify For Tax Relief. Ad See If You Qualify For IRS Fresh Start Program.

Cryptocurrency Taxes What To Know For 2021 Money

Understanding California S Sales Tax

Business Activity Code For Taxes Fundsnet

The Irs 1040 Hotline Is Answering Only 1 Out Of Every 50 Calls The Washington Post

How To Claim Missing Stimulus Payments On Your 2020 Tax Return

How To Get Your Maximum Tax Refund Credit Com

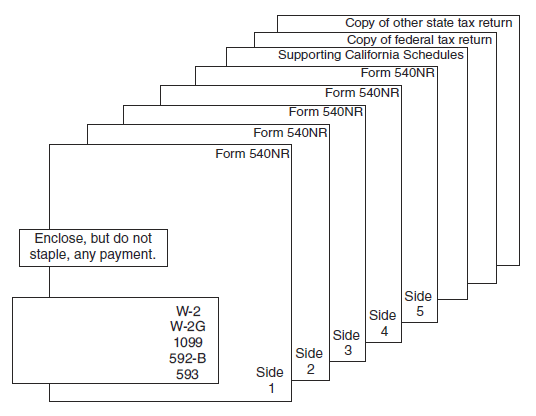

Irs Form 540 California Resident Income Tax Return

Pin On New Start Tax Consulting Blog Posts

What Will The Irs Look For In A Sales Tax Audit Tax Consulting Irs Tax

It S Been A Few Years Since I Filed A Tax Return Should I Start Filing Again H R Block

![]()

What Will The Irs Look For In A Sales Tax Audit Tax Consulting Irs Tax

How Much To Set Aside For Small Business Taxes Bench Accounting

Irs Form 540 California Resident Income Tax Return

.png)

Maximizing Tax Deductions For The Business Use Of Your Car Turbotax Tax Tips Videos

.png)